Decentralized finance, or this emerging ecosystem, is revolutionizing the financial landscape by leveraging blockchain technology to create a more open, transparent, and inclusive system. Participants can now access a wide range of financial services, such as lending, borrowing, trading, and investing, without relying on traditional intermediaries like banks or brokers.

The beauty of DeFi lies in its open-source nature. Anyone with an internet connection can participate, regardless of their location or financial history. This opens up a world of possibilities for individuals and businesses alike.

However, DeFi is still a relatively young space, and there are certain considerations that need to be addressed. Security remain key concerns, and it's essential for users to conduct thorough research before engaging.

Bitcoin Basics: A Beginner's Guide to copyright Investing

Diving into the realm of copyright can feel overwhelming, but understanding the basics of BTC is a great starting point. Bitcoin is a decentralized, virtual currency that operates independently of traditional financial systems. Transactions occur directly between users on the Bitcoin network, recorded in a public blockchain called the distributed ledger.

- Understanding key concepts like mining, digital storage, and market volatility is crucial for navigating the world of Bitcoin investing.

- Before trading, it's important to research the risks involved. Bitcoin's price can be highly fluctuating, and there are various security threats to be aware of.

- Commence your journey by educating yourself on reputable sources, exploring different copyright exchanges, and always practice responsible investing habits.

Navigating copyright Trading Strategies for Profitable Outcomes

Diving into the volatile world of copyright trading requires a strategic mindset and a willingness to learn. To optimize your chances of success, it's crucial to hone robust trading strategies that align with your risk tolerance and financial goals. Comprehending market trends, technical analysis indicators, and fundamental factors are crucial components of a successful copyright trading plan. Utilizing cutting-edge tools, staying informed about industry news, and refining your skills through simulated trading can significantly improve your performance in the dynamic copyright landscape.

- Investigate various trading styles, such as day trading, swing trading, and long-term investing, to identify the approach that resonates best with your trading personality and objectives.

- Adopt risk management strategies, including stop-loss orders and position sizing, to reduce potential losses and protect your capital.

- Remain updated on regulatory changes, technological advancements, and market sentiment, as these factors can influence copyright prices significantly.

Discover Blockchain: The Technology Revolutionizing Finance

Blockchain technology is rapidly revolutionize the financial landscape. This decentralized ledger system enables a wide range of advantages, including improved security, enhanced transparency, and reduced transaction costs. Blockchain uses in finance span copyright, self-executing contracts, and logistics tracking. As blockchain adoption grows, it has the potential to revolutionize the way we manage financial transactions.

Blockchain's unalterable nature ensures that data are secure and verifiable. This characteristic makes it perfect for financial applications where integrity is paramount. Furthermore, blockchain's decentralized architecture eliminates the need for a central authority, expediting transactions and minimizing fees.

- Explore these key benefits of blockchain in finance:

- Enhanced security through cryptography and decentralization.

- Auditable records that allows all participants to view transactions.

- Faster transaction processing times.

- Reduced costs by eliminating intermediaries.

Exploring the copyright Market: Risks and Rewards Explained

The dynamic nature of the copyright market presents both substantial risks and equally rewarding opportunities. Savvy investors must carefully scrutinize market trends, understand the underlying systems, and implement a strategic investment approach. While the potential for exorbitant gains is undeniable, it's crucial to acknowledge the inherent uncertainty and diversify your investments wisely.

- Executing thorough research on individual cryptocurrencies is essential before making any investment decisions.

- Keeping informed about market news and developments can help you make more informed choices.

- Leveraging risk management tools, such as stop-loss orders, can help mitigate potential losses.

Transforming HODL into Gains: A Roadmap for copyright Success

The copyright space is a wild ride, known for its volatile swings and unpredictable trends. But just like any market, success in copyright demands knowledge. It's not just about buying and holding your assets and hoping for the best; it's about actively optimizing your portfolio to maximize gains. This roadmap will guide you through key steps to transform your HODLing journey learn about blockchain into a profitable one.

- Immerse deep into the world of cryptocurrencies, researching different projects, understanding their use cases, and analyzing market trends.

- Craft a solid investment strategy that aligns with your risk tolerance and financial goals. Don't just follow the hype; make informed decisions based on research and analysis.

- Allocate your investments across different copyright assets to mitigate risk. Don't put all your eggs in one basket; explore a range of projects and sectors within the copyright ecosystem.

- Stay informed about the latest developments, regulations, and news that can impact the market. The copyright landscape is constantly evolving, so staying up-to-date is crucial.

- Utilize tools like charting platforms, technical indicators, and fundamental analysis to make analytical trading decisions.

Remember, success in copyright requires patience, discipline, and a long-term perspective. Avoid emotional trading based on fear or greed. Stay focused on your strategy, manage your risk effectively, and ride the waves of this dynamic market with knowledge and confidence.

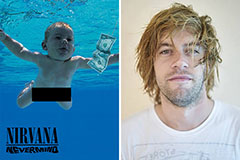

Spencer Elden Then & Now!

Spencer Elden Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!